The Trade Union Congress of Nigeria (TUC) has rejected the Federal Government’s proposal to increase the Value Added Tax (VAT) rate, warning that such a move would exacerbate the economic challenges faced by Nigerians.

The proposed phased VAT hike, outlined in the Federal Government’s Tax Reform Bills, seeks to raise the current rate of 7.5% to 10%, 12.5%, and ultimately 15%. The TUC, however, described the plan as ill-timed and detrimental to the welfare of citizens already struggling with inflation, unemployment and rising living costs.

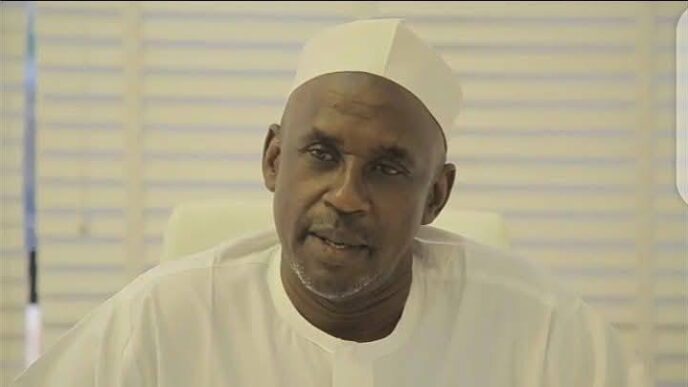

During a press briefing in Abuja on Tuesday, TUC President Festus Osifo, speaking after the union’s National Executive Council meeting on November 26, 2024, emphasised the importance of maintaining the VAT rate at 7.5% to safeguard households and businesses from additional financial strain.

“Allowing the Value Added Tax rate to remain at 7.5 per cent is in the best interest of the nation,” Osifo stated. “Increasing it now would impose an additional burden on households and businesses already struggling with economic challenges.”

He added that raising VAT could stifle economic growth by eroding consumer purchasing power and discouraging spending.

The TUC also called on the Federal Government to review the tax exemption threshold, advocating for an increase from N800,000 to N2.5 million per annum to provide relief for low-income earners.

“This measure would increase disposable income, stimulate economic activity, and provide relief to struggling Nigerians,” Osifo explained.

He further stated, “The threshold for tax exemptions should be increased to N2,500,000 per annum. This adjustment would offer much-needed relief to low-income earners, enabling them to cope with the current economic challenges.”

The TUC expressed concerns about the proposal to transfer the collection of royalties from the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) to the Nigeria Revenue Service (NRS). The union warned that such a shift could lead to revenue losses, inefficiencies and reduced investor confidence.

The TUC commended the government for retaining the Tertiary Education Trust Fund (TETFund) and the National Agency for Science and Engineering Infrastructure (NASENI), highlighting their critical roles in education and technological development.

“These institutions have significantly contributed to improving tertiary education and fostering homegrown technologies. Their continued existence is vital for sustained progress in education, technology, and national development,” Osifo said.

The TUC urged the Federal Government to adopt tax policies that prioritise citizens’ welfare and promote equitable economic growth.

![Anambra uncovers kidnappers' den with 30 graves in Onitsha [VIDEO]](https://witnessngr.com/wp-content/uploads/2025/01/Anambra-Kidnappers-den-3-332x154.png)

![Anambra uncovers kidnappers' den with 30 graves in Onitsha [VIDEO]](https://witnessngr.com/wp-content/uploads/2025/01/Anambra-Kidnappers-den-3-688x348.png)