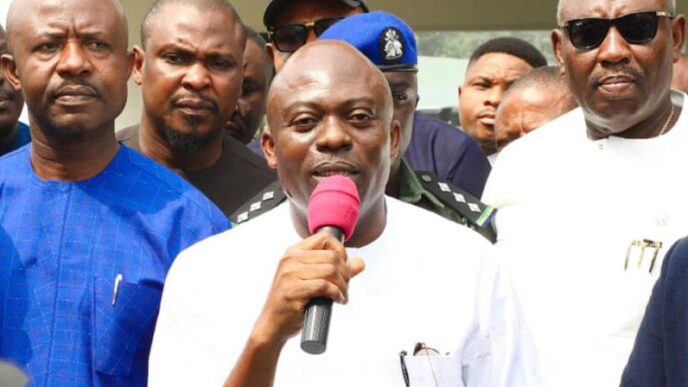

Kelechukwu Mbagwu, the chief executive officer of CMB Building Maintenance & Investment Company Limited, is in fresh trouble over alleged N1 billion fraud.

The Witness reports that a Federal High Court in Lagos has set April 30 for the arraignment of the real estate tycoon on charges of conspiracy, obtaining by false pretence, and committing a N1,026,968,433 fraud.

Kelechukwu Mbagwu is facing these charges alongside his company, CMB Building Maintenance & Investment Company Limited Ltd., following an investigation by the Police Special Fraud Unit (PSFU) in Ikoyi, Lagos.

Both Mbagwu and his company were initially scheduled for arraignment on February 12, but the court postponed the proceedings to April due to the defendants’ absence.

The charges, which date back to 2019, accuse Mbagwu and his company of falsely presenting a sold property in Oniru, Victoria Island, Lagos, to Access Bank in order to secure a loan of over N1 billion.

Mbagwu and CMB Building are also alleged to have unlawfully converted the loan funds to his personal use.

The police’s charges are based on violations of Section 8(i)(a) and Section 1(i)(a) of the Advance Fee Fraud and Other Fraud Related Offences Act, No. 14 of 2006, which are punishable under Section 1(3) of the same Act. The charges also relate to Section 18(2)(b)(d) of the Money Laundering (Prevention and Prohibition) Act, 2022, punishable under Section 18(3) of the Act.

The charges against Mbagwu and his company read in part:

“That you Kelechukwu Mbagwu (Managing Director), CMB Building Maintenance & Investment Co. Ltd, and other directors (now at large), sometime in 2019, in Lagos, with intent to defraud, conspired to commit felony by obtaining money by false pretence, an offence contrary to Section 8(i)(a) and punishable under Section 1(3) of the Advance Fee Fraud and Other Fraud Related Offences Act, No. 14 of 2006.

“That you, Kelechukwu Mbagwu, did falsely present to Access Bank, claiming that the property located in Oniru, Victoria Island, was owned by you and that you had title to it at the time of the transaction, while knowing that the property had already been sold to a third party without disclosing this to the bank. This misrepresentation is an offence under Section 1(i)(a) of the Advance Fee Fraud and Other Fraud Related Offences Act, No. 14 of 2006.

“That you, Kelechukwu Mbagwu, directly or indirectly converted, transferred, retained, or took possession of N1,026,968,433 belonging to Access Bank Plc, knowing that the funds were proceeds of an unlawful act, in violation of Section 18(2)(b)(d) and punishable under Section 18(3) of the Money Laundering (Prevention and Prohibition) Act, 2022.”

The court will now proceed with the arraignment of Mbagwu and his company on April 30.