Fresh details have emerged over the un-ending crises rocking Nigerian lender, First Bank of Nigeria Limited and its parent company, FBN Holdings Plc.

Recall The Witness reported that the Economic and Financial Crimes Commission, EFCC, has identified two former board members of the financial institution as the ‘men’ behind the imminent collapse of the bank as the duo allegedly obtained the sum of N12.3bn from First Bank under false pretense. .

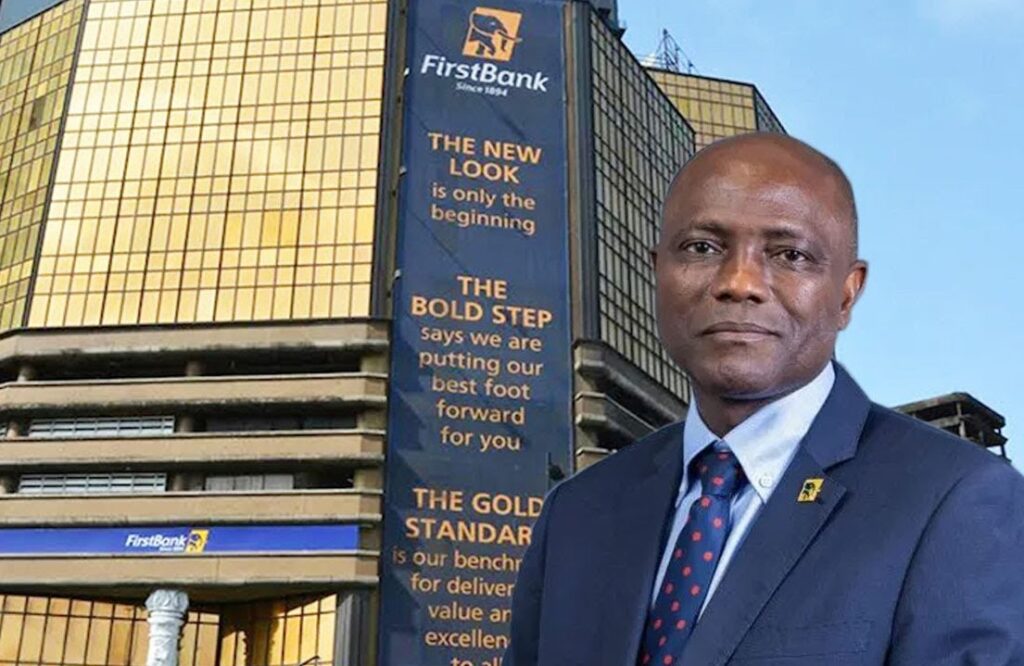

The board members as listed by the anti-graft agency are Chief Oba Otudeko, a former chairman of FBN Holdings and chairman of Honeywell Group and Olabisi Onasanya, a former chief executive of First Bank.

How It All Started…

Recall, a former relationship manager at First Bank of Nigeria, Adesuwa Ezenwa, had alleged in August 2024 that loans worth billions of naira were transferred to companies related to Oba Otudeko, then chairman of the bank, even though they were granted in the name of other firms.

Adesuwa Ezenwa who is currently at the National Industrial Court (NIC), Lagos, division, claiming unfair dismissal by FBN, said she was dismissed on October 5, 2016 on fraudulent loan disbursements “without any explanation” as to her culpability.

After her sack, she was invited to appear before a credit disciplinary committee reviewing facilities granted to a firm known as Supply and Services Ltd, a subsidiary of Royal Ceramics Group — a major customer of the bank.

Although the committee cleared her of having any interest in the loans disbursed, Ezenwa said she was admonished during the disciplinary proceedings for not “whistleblowing on some of the transactions approved by her group head (Mr Olatunji) and the Executive Vice President (Mrs. Cecilia Majekodunmi)”.

She said the admonition was most unfair and unwarranted as she was in no position to whistleblow on her superiors, “though some of the loan facilities reviewed were unsecured facilities granted to companies in which the chairman of the bank, Chief Oba Otudeko and the erstwhile Managing Director, Mr Bisi Onasanya, had substantial investments”.

In another instance, she said, an “unsecured facility” of N2 billion was granted in 2012 to Broadwaters Resources Company Nigeria Ltd, which she said turned out to be a mere conduit pipe employed by Majekodunmi and Onasanya “for siphoning monies from the bank”.

The loan, according to the court filing, was never repaid.

“Out of the N12 billion camouflaged as lending to the Stallion Group, N8.21 Billion was transferred through various accounts to a final destination account belonging to a company known as V TECH LTD which belongs to the Chairman of FBN Holdings, Oba Otudeko while the sum of N4.45 Billion out of the same fictitious facility was transferred to Ontario Oil and Gas. The facility remains unpaid to date,” the document reads.

“These were not the only acts of malfeasance by the top management of the Bank but several other transactions were undertaken by other top management staff for which the Plaintiff is being punished.

“Apart from funds camouflaged as loans granted to the Stallion Groups, similar loans were granted over the years by Mr. Olatunji (the Branch Manager) and Mrs. Cecilia Majekodumi to other customers of the Bank amongst which are SUPPLIES AND SERVICES LTD. Supplies and Services Ltd is a subsidiary of ROYAL CERAMICS GROUP OF COMPANIES and several loan approvals were initiated and authored by Mr. Olatunji and Mrs. Majekodunmi.

“The facilities granted to Supplies and Services Ltd was subsequently sublent and disbursed in smaller bits to several customers on more profitable terms to both officers and these customers include Swap Technologies and Telecomms Plc, Netconstruct Nigeria Ltd, Orbit Cargo, High Performance Distributions Ltd etc.

“Some of the transactions undertaken by the Bank are already being investigated by the Economic and Financial Crimes Commission (EFCC). Their investigations/Report will be relied on at the trial.”

Ezenwa said given the size of the loans, the board of the bank “cannot but be complicit in the lendings, which were above the limits of the executive directors, vice-president and managing director of the bank”.

EFCC Wades In…

The EFCC has now filed a 13-count criminal charge against Otudeko and Onasanya for the alleged crime.

The duo are to be arraigned on Monday, Jan 20th before Justice Chukwuejekwu Aneke of the Federal High Court, Lagos.

They will be arraigned alongside, a former member of the board of directors of Honeywell Flour Mills Plc, Soji Akintayo and a company linked to Otudeko, named Anchorage Leisure Ltd.

All four were listed as defendants in the suit filed by an EFCC prosecutor, Bilkisu Buhari-Bala on Jan. 16, 2025.

According to the EFCC, the four committed the fraud in tranches of N5.2b, N6.2b, N6.150b, N1.5b and N500million, between 2013 and 2014 in Lagos.

In proof of the charge against the defendants, the EFCC intends to call representatives of First Bank including Cecelia Majekodunmi, Ola Michael Aderogba, Abiodun Olatunji, Raymond Eze, Abiodun Odunbola and Adeeyo David all of whom are expected to give evidence of the fraudulent misrepresentation of the Defendants and tender relevant documents.

The EFCC will also rely on the testimonies of representatives of Central Bank of Nigeria, representatives of Stallion Nigeria Limited and representatives of V-tech Dynamics Ltd.

Also included in the EFCC’s list of witnesses are one Farida Abubakar and Adaeze Nwakoby.

According to the Commission, the offences contravene Section 8(a) of Advance Fee Fraud and Other Fraud Related Offences Act 2006 and were punishable under Section 1 (3) of the same Act.

Count 1 of the charge says that Chief Oba Otudeko, Stephen Olabisi Onasanya, Soji Akintayo and Anchorage Leisure Limited between 2013 and 2014 in Lagos, within the jurisdiction of this Honourable Court conspired amongst yourselves to obtain the sum of N12,300,000,000.00 (Twelve Billion, Three Hundred Million Naira Only),from First Bank Limited on the pretence that the said sum represented credit facilities applied * for by V- Tech Dynamic Links Limited and Stallion Nigeria Limited, which representation you know to be false, and you thereby committed an offence contrary to Section 8(a) of Advance Fee Fraud and other Fraud Related Offences Act 2006 and punishable under Section 1(3) of the same Act.

In Count 2, it was alleged that the defendants, on or about 26th day of November, 2013 in Lagos, “obtained the sum of N5.2 Billion from First Bank Limited on the pretence that the said sum represented credit facilities applied for by V Tech Dynamic Links Limited which representation you know to be false.”

The 3rd count claims that the defendants, between 2013 and 2014 in Lagos, obtained N6.2 Billion from First Bank Limited on the pretence that the said sum represented credit facilities applied for and disbursed to Stallion Nigeria Limited, which representation you know to be false.”

County 4 reads, that you, Chief Oba Otudeko, Stephen Olabisi Onasanya, Soji Akintayo and Anchorage Leisure Limited on or about 26th day of November 2013 in Lagos, within the jurisdiction of this Honourable Court conspired amongst yourselves to use the total sum of N6,150,000,000,.00 (Six Billion, One Hundred and Fifty Million Naira Only.), which sum you reasonably ought to have known forms part of proceeds of your unlawful activities to wit: Obtaining by False Pretence and you thereby committed an offence contrary to Sections 18(a), 15 (2) (d) of the Money Laundering (Prohibition) Act, 2011 (as amended) and punishable under Section 15(3) of the same Act.

Count 5 accuses Chief Oba Otudeko, Stephen Olabisi Onasanya, Soji Akintayo and Anchorage Leisure Limited on or about 11th day of December, 2013 in Lagos, procured Honeywell Flour Mills Plc to retain the sum of N1.5 billion, which sum you reasonably ought to have known forms part of proceeds of your unlawful activities to wit: Obtaining by False Pretence and you thereby committed an offence contrary to Section 18(c), 15 (2) (d) of the Money Laundering (Prohibition) Act, 2011 (as amended) and punishable under Section 15(3) of the same Act.