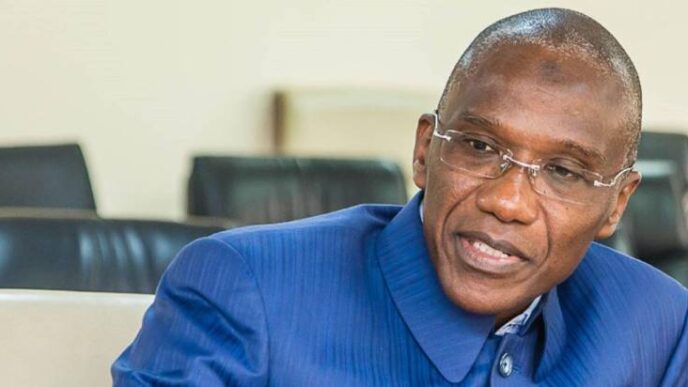

Viva Atlantic Limited, Technology House Limited, alongside their Managing Director and Chief Executive Officer, Mr Norman Didam, have been banned by the World Bank Group for fraudulent, collusive, and corrupt practices linked to the National Social Safety Nets Project in Nigeria.

In a statement issued on Monday, the World Bank disclosed that the project aimed to provide targeted financial assistance to poor and vulnerable households was compromised due to several unethical practices during a 2018 procurement and subsequent contract process.

The statement read, “The World Bank Group today announced the 30-month debarment of two Nigeria-based companies—Viva Atlantic Limited and Technology House Limited—and their Managing Director and Chief Executive Officer Mr. Norman Bwuruk Didam.

“The debarment is in connection with fraudulent, collusive, and corrupt practices as part of the National Social Safety Nets Project in Nigeria.”

The bank said that Viva Atlantic Limited, Technology House Limited, and Didam misrepresented a conflict of interest in their bids and accessed confidential tender information from public officials.

It added that these actions constituted fraudulent and collusive practices under its Anti-corruption Framework.

The World Bank further noted that Viva Atlantic Limited and Didam falsified the company’s experience records, submitted fake manufacturer’s authorisation letters, and provided inducements to project officials, which it classified as corrupt practices.

These violations, according to the bank, undermined the integrity of the social safety net initiative designed to benefit Nigeria’s most vulnerable populations.

The statement noted, “According to the facts of the case and the general principles of the World Bank’s Anticorruption Framework, in connection with a 2018 procurement and subsequent contract, Viva Atlantic Limited, Technology House Limited, and Mr. Didam misrepresented a conflict of interest in the companies’ Letter of Bids and received confidential tender information from public officials, which constituted fraudulent and collusive practices, respectively.

“Further, Viva Atlantic Limited and Mr. Didam misrepresented Viva Atlantic Limited’s experience and submitted falsified manufacturer’s authorization letters, as well as offered and provided things of value to project public officials. These actions were fraudulent and corrupt practices, respectively.”

The debarment precludes the two companies and Didam from participating in World Bank-financed projects and operations for the specified period.

As part of their settlement agreements, the parties acknowledged their culpability and committed to meeting specified conditions, including enhanced compliance measures.

The conditions require Didam to complete individual ethics training, while the companies are mandated to improve their internal integrity compliance policies and implement corporate ethics training programmes in line with the bank’s Integrity Compliance Guidelines.

The bank highlighted that reduced debarment periods were granted due to the parties’ cooperation during investigations, voluntary corrective actions, self-imposed restraints from bidding for contracts, and the time elapsed since the infractions.

The statement added that the debarments qualify for cross-debarment by other multilateral development banks under the Agreement for Mutual Enforcement of Debarment Decisions, signed in April 2010.

It also stated, “The companies also commit to continue to fully cooperate with the Bank Group Integrity Vice Presidency. The settlement agreements feature reduced debarment periods due to the companies’ and Mr Didam’s cooperation with the Bank Group’s investigation, voluntary corrective actions, voluntary restraint from participating in Bank Group tenders, and the passage of time.”

The World Bank reiterated its commitment to ensuring transparency and accountability in development projects, stressing that the sanctions demonstrate its zero-tolerance approach to corruption.

It said the implicated parties must fulfil the stipulated conditions during the debarment period to regain eligibility for participation in future Bank-funded initiatives.