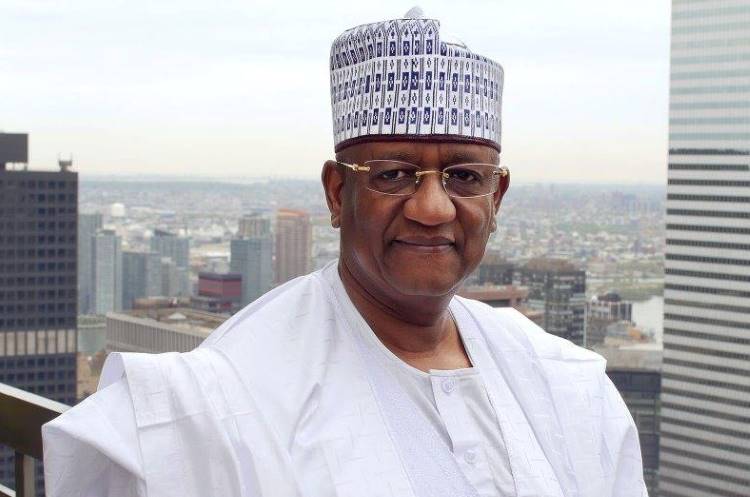

A boardroom crisis that may rock Muhammadu Indimi’s Oriental Energy Resources Limited to its foundation is currently brewing in the oil company, The Witness reports.

The crisis involves Alhaji Muhammadu Indimi, a top Nigerian businessmen and chairman of the company and his children over the ownership and control of the oil firm, Oriental Energy.

While Indimi is the chairman of the oil company, the children are board members.

Information reaching this newspaper revealed that Indimi’s children are not happy with the businessman over the operations of the company. The crisis if not properly managed, may sink the soaring oil firm.

The children are said to have accused Indimi of intimidation and coercion, alleging that he forced them, as board members, to transfer their shares in the company to him.

The dispute revolves around $435 million in dividends, with the company reportedly telling a Federal High Court that Indimi bought out his children’s stakes for $10 million, effectively nullifying their claim to $43.5 million in unpaid dividends.

This controversy comes just months after Indimi hosted Vice President Kashim Shettima and several Nigerian governors in Dubai for the commissioning of his Floating Production Storage and Offloading (FPSO) vessel for the Okwok Field—a project expected to boost Nigeria’s crude oil output by 30,000 barrels per day.

In November 2023, two of his daughters, Ameena Indimi Dalhatu and Zara Indimi, both former board members of Oriental Energy, filed a lawsuit against the company, alleging they were unfairly denied their share of $435.1 million in declared dividends from 2016.

They claimed their father intimidated them and other board members into transferring their shares to him, increasing his ownership from 60% to 99.94%, while reducing their individual stakes to just 0.6% each.

They insisted they are jointly entitled to 10% of the company’s dividends—around $43.5 million—and accused their father of high-handedness and failing to establish proper corporate governance structures.

In a counterclaim, Oriental Energy dismissed the allegations, arguing that Indimi legally compensated his children for their shares.

The company maintained that each of the eight affected shareholders received a combined $10 million in exchange for their stakes—money which, it claims, Indimi originally gave them as a gift.

According to court filings, Ameena Indimi, who was then the company’s Managing Director, received $3 million in her Stanbic IBTC account on July 19, 2016, while seven other siblings—including Zara—were paid $1 million each in the same week.

The beneficiaries reportedly include: Mustafa Indimi, Ahmed Mohammed Indimi, Amina Indimi Fodio, Rahama Yakolo Indimi Babangida, Jibrilla Indimi and Ibrahim Indimi.

Oriental Energy presented emails purportedly sent by Ameena Indimi on May 22, 2016, in which she allegedly advised her father to offer a financial incentive to persuade shareholders to sign away their dividend rights.

One of the emails reads: “Dear Baba, in preparation for the board meeting, please find attached a draft for the transfer of all dividend rights from all 5% stakeholders to the principal shareholder. It is still a draft, and we will get a document ready by Thursday morning, Insha Allah. The struggle we have is that, in order for this to work, you will have to incentivize the shareholders by putting a sweetener on the table.”

Oriental Energy claims that the $10 million payout was this so-called “sweetener” and insists that Indimi should not be dragged into the lawsuit.

Oriental Energy denied allegations that the company declared $435 million in dividends in 2016 while refusing to disclose how much was actually paid out.

The company also rejected claims that it lacked proper corporate governance structures or had received warnings from federal tax authorities.

It has asked the Federal Court to dismiss the lawsuit, arguing that it has no merit since the plaintiffs were already compensated.

Founded in 1990, Oriental Energy operates three major offshore oil projects in Nigeria: OML 115, Ebok Field (OML 67) and Okwok Field (OML 67).

As of October 2023, Indimi’s net worth was estimated at US$500 Million by Forbes. His net worth plummeted due to crashing oil prices as well as the floating of the Naira.