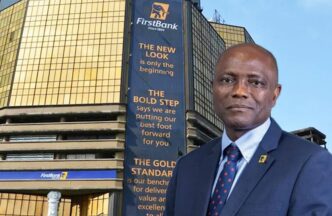

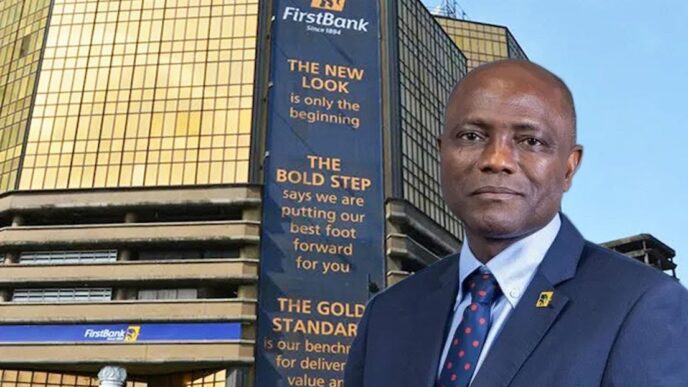

A shareholders’ group has raised the alarm over the ongoing crisis at FBN Holdings Plc, the parent company of First Bank of Nigeria Limited, stating that unresolved governance and strategic disputes could result to the collapse of the bank, regulatory intervention, and significant financial losses for investors.

The National Chairman of the New Dimension Shareholders Association, Mr. Patrick Ajudua, stressed the urgency of regulatory action during a recent interview with journalists.

“The regulator owes it a duty to ensure that rules and laws are strictly followed in resolving the various contending issues currently rocking FBN Holdings Plc. Failure to do so may lead to the collapse of the bank, eventually resulting in a regulatory takeover and the loss of our investment,” he stated.

FBN Holdings Plc, one of Nigeria’s oldest and largest financial institutions, has faced mounting governance challenges that have eroded investor confidence and raised concerns about its long-term stability.

A group of shareholders holding 10 per cent of the company’s shares on Wednesday formally requested an Extraordinary General Meeting, citing Section 215(1) of the Companies and Allied Matters Act (CAMA). Among the agenda items are calls for the removal of Group Chairman Mr. Femi Otedola and Mr. Julius B. Omodayo-Owotuga, a non-executive director.

The shareholders alleged that Otedola’s emergence as chairman was facilitated by former Central Bank of Nigeria Governor Godwin Emefiele, who reportedly supported Otedola’s acquisition of substantial shares.

They claimed that this development has since disrupted the bank’s governance structure, leading to instability and executive conflicts.

Further accusations include the dismissal of former CEO Dr. Adesola Adeduntan, the sidelining of Tunde Hassan-Odukale, and the alleged bypassing of top-performing candidates for key leadership positions.

In response, on Thursday, FBN Holdings Plc issued a statement assuring stakeholders that the ongoing disputes will not impact its operations.

The bank emphasized its commitment to corporate governance and highlighted improved financial performance and a growing market capitalization.

“This matter does not in any way impact the operations of the company, and all businesses within the group continue to provide uninterrupted services to customers. We are taking all necessary steps to protect the interests of the company and its subsidiaries,” the statement reads.

The crisis has prompted calls for decisive intervention from the Central Bank of Nigeria and the Securities and Exchange Commission. Shareholders have urged regulators to enforce compliance, resolve disputes, and ensure the bank’s stability in the interest of Nigeria’s financial system.

“We have continuously advocated for all stakeholders to prioritize the bank’s survival above personal interests and ensure amicable resolutions,” said Ajudua.

The resolution of FBN Holdings Plc’s challenges is crucial not only for the institution but also for maintaining investor confidence and safeguarding the broader financial sector.

As stakeholders await further developments, the spotlight remains on regulatory authorities to restore stability and uphold the principles of corporate governance.

The outcome of this crisis will serve as a litmus test for the resilience of Nigeria’s banking industry and its ability to manage governance challenges effectively.

The CBN and SEC that oversee the operations of financial institutions in the country, are being urged to act swiftly and decisively to restore stability to FBN Holdings Plc.